Ayn Rand’s writings reflect Objectivist thinking, and her views on money, as expressed in her book Atlas Shrugged, are very interesting. According to Rand (and possibly other Objectivists), money is the essence of morality – in a free world, money is made only through the conduct of business, and thus, is a symbol of human achievement and progress.

Okay, so the world is not exactly riding the crest of an economic boom right now 🙂 – but this makes money management for businesses all the more important! Therefore, those of you who want to be in this business of managing money have plenty of opportunities.

So let’s look at various career tracks in finance:

1. Corporate Finance

In this role, you will be involved in making long-term and short-term monetary decisions for a business – when and what to invest in, how to finance investments (debt or equity?), how much dividend to pay to shareholders (if at all!), manage company budget, cash flow and credit etc.

Corporate finance has many divisions: financial planning & analysis (FP&A, the financial strategy department that is responsible for forecasting and managing P&L), controllership (the hardcore accounting guys), treasury (the department that manages cash flow), tax, pricing, internal audits etc.

Typical Career Progression:

Contrary to popular notions that corporate finance is a ‘back end’ role where the stars go to die, there are many interesting opportunities for growth available in this line. With a graduate degree in finance, one can join the corporate finance team as an Analyst. But to progress to higher levels, one requires either an MBA or other higher qualifications (MS in finance, CFA, CA, ICWA etc.) Finance MBAs typically angle for the CFO post in the long run by starting out in FP&A.

What Does It Take To Build A Career In Corporate Finance?

Number-crunching skills

Analytical mindset

Attention to detail

Knowledge of tools and software (especially Excel!)

Team player attitude

The Pros And Cons Of Corporate Finance

Pros: Mostly good work-life balance, little associated risk/uncertainty

Cons: The money you make in corporate finance depends, to a large extent, on the health of the company you work with.

2. Investment Banking

This is possibly the most glamorous of finance careers – and for good reason! Investment banks perform a number of functions: underwriting, raising capital for client organizations through debt and equity, facilitating mergers & acquisitions, offering financial advisory services etc. In most of these cases, the investment bank plays the role of middleman.

Investment banks are broadly categorized as bulge bracket banks and boutique banks. Bulge bracket banks are highly profitable, multinational full-service banks that serve most industries. JP Morgan, Goldmann Sachs, Morgan Stanley, Deutsche Bank, Barclays etc. are often categorized in this band. Boutique banks, on the other hand, either specialize in certain services, industries or markets.

For example, Lazard, Evercore, Gleacher etc. specialize in M&As and restructuring; Allen & Co. (media), Cowen & Co. (healthcare), Berkery Noyes (education) focus on specific industries; William Blair, Piper Jaffray, Houlihan Lokey etc. specialize in mid-sized deals and mid-sized clients.

Investment banks usually have two internal divisions, based on product and on industry. Product bankers are experts in their product (M&A, restructuring, financial advisory etc) and aid the client in executing transactions related to these products. Industry bankers work with clients from specific industries such as retail, oil & gas, automobiles, healthcare etc., and need to do more marketing activities by making pitches to prospective clients.

Typical Career Progression:

As in most finance career tracks, one can start out as an Analyst in investment banking with an undergraduate degree in finance. With an MBA from a top school and a few years of industry experience, one can reach the Associate level.

What Does It Take To Build A Career In Investment Banking?

Solid foundation in finance

Analytical skills

Problem-solving aptitude

Sales & people skills

The Pros And Cons Of Investment Banking

Pros: The money (LOTS of it!), the status & ‘I-Banker’ tag, the opportunity to work on challenging assignments with very bright colleagues

Cons: 80+ hour work weeks, work pressure, general risk/uncertainty (after 2008, I’m sure you know why!)

3. Equity Research

Equity researchers’ job is to advise investors on what stocks to invest in, by tracking monitoring companies and industries and generating reports on hold/buy/sell recommendations. Much of the work is researching information and analysing & modelling data to create these reports and make these recommendations. Senior analysts do more client and investor interaction, and less of the grunt work.

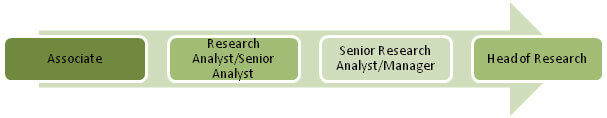

Typical Career Progression In Equity Research:

What Does It Take To Build A Career In Equity Research?

Passion for the stock markets

Strong industry knowledge

Number crunching skills

Solid research skills & attention to detail

Strong grasp of financial modelling tools

The Pros And Cons Of Equity Research

Pros: Scope for autonomy and creativity even at Associate levels, opportunities to become an expert on particular industries, chance to meet/interact with investors and senior management (at Analyst levels and above)

Cons: Long working hours; cubicle-bound work; and the analysis/modelling can become somewhat tedious at times

4. Retail & Commercial Banking

Retail and commercial banks employ the maximum number of people working in the finance sector. They offer banking services to individuals and organizations.

In a nutshell, they take deposits from one set of customers and use these to lend money to borrowers. The banks’ income comes from the difference in the interests they charge and offer. Multinational biggies in this domain include Bank of America and JP Morgan. As a retail or commercial banker, one can work in loans processing, credit analysis, branch operations management, mortgage banking, commercial cards etc.

Typical Career Path In Retail /Commercial Banking

There is no linear, clearly defined career path in retail and commercial banking. Your progression depends on where you begin and which bank you join. An MBA is not mandatory for career progression in this domain, though of course, it does help.

What Does It Take To Build A Career In Retail /Commercial Banking?

Good people skills

Communication & selling skills

Fundamentally sound in finance

The Pros And Cons Of Retail/Commercial Banking

Pros: Relatively stress-free as compared to other finance jobs, plenty of opportunities for customer interaction

Cons: The money is modest compared to investment banking, limited exit options from the domain

5. Private Equity/Venture Capital:

Both VCs and PEs invest in companies and make money by selling their equity. However, there are some differences between the two: VCs are usually more interested in promising start-ups, while PEs invest in more mature companies; VCs typically focus on technology companies whereas PEs invest in industries across the board; PEs usually hold a bigger stake in the companies they invest in, than do VCs.

This could range from very small to sizeable stakes, depending on the investment styles, policies and amounts of the companies. Typically though, VC funding is less than PE funding. Both VC and PE firms hire finance MBAs with a good bit of investment banking or equity research experience – it is very unlikely that a fresh finance MBA gets to join a VC or PE firm.

What Does It Take To Build A Career With PE/VC Firms?

Solid core finance knowledge

Specific industry expertise

Independent decision-making skills

Analytical skills

The Pros And Cons Of Working With PE/VC Firms:

The work in PE firms involves a lot of analysis, modelling, due diligence, examining financial statement etc. The work in VC firms is not so focused on numbers – there is a good bit of relationship building involved.

However, the money is much better in PE firms than in VC firms. PE firms mostly employ ex-I-Bankers, and the work atmosphere there would be similar to that in investment banks. In VC firms, you may get to work with people from diverse backgrounds – consultants, marketers, analysts etc.

Caveat Emptor For Finance Aspirants

It all sounds too good to be true, right? So here’s the catch:

Finance is one functional area that is very difficult to break into if you have 4+ years of work experience in a different industry/role, even with an MBA from a top school.

Recruiters may compare you unfavourably with someone who has been crunching numbers and making balance sheets all his life, and pick him/her over you. Even if you do manage to get a foot in the door, you would probably be starting at the bottom, and not leveraging all your years of work experience.

B-schools Renowned For Finance

Wharton, Harvard, Stanford, Chicago Booth, NYU Stern, Cornell Johnson, London Business School, ISB, IIM A

Read our previous blog post in this 5 part series on Post MBA careers: Sales and Marketing

Read our next blog post in this 5 part series on Post MBA careers: Operations

Are you wondering if you can get into a top B-School this year? Let us help you!

[button href=”http://applications.crackverbal.com/free-profile-evaluation/” style=”emboss” size=”medium” textcolor=”#ffffff”]Get your Profile Evaluated![/button]